Paydox offer your business exceptional value by providing comprehensive and reliable HR administrative services that combine innovation and common sense.

Integrated & Automated Business Administrative Services : Payroll, Statutory Compliance, HRMS through an online ERP.

Access our services through online that can help to enhance the productivity and effectiveness of your business.

Payroll process

Leave account management

Muster roll management

Process bonus

Generate Reports

HRMS

EPF returns

ESI returns

Wage Protection Data processing

Generate Statutory Registers & Returns

All other regulatory Compliances

Assistance under Labour laws

Compliance due info

Legal representations

HR advice

Statutory Audit

Other legal consultations

Advance Tax deductions

Yearly tax settlements

Income Tax statements

Professional Tax statements

Completion of relevant documentation that are prerequisites for obtaining various sanctions

Integrating data from multiple sources

Analytical reporting

Decision making

Periodical backups

Custom Reports

Receipts & process of inputs are done through an automated application environment ERP exclusively developed. Data will be stored in a secured server and provide periodical backups to their clients.

99.9% data accuracy will be attained by a fool proof validation system provided in the application.

Paydox solutions is backed by technical & legal professionals with advanced office automation concepts.

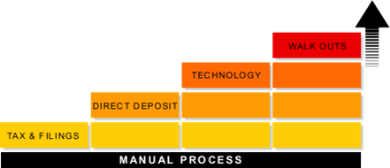

40 % of businesses pay an avg. penalty of $1000 per year for late or incorrect statutory filings and payments and it can be reduced in automated processes.

Direct deposit is difficult if a company doesn't use an outside automated payroll service. Direct deposit is a must to implement Wage Protection System WPS introduced by the State.

Results in stiff penalties if you don’t have a latest ver. of your software to keep up with the changes in regulations & if your controller gets a new job, he will walkout the door with his knowledge.

Before you start thinking of reducing administrative overheads in business, let us see what they are.

Administrative overheads are the costs which are not involved in the production of goods or service. Administrative overhead costs are the costs incurred for payroll expenses of employees, wages of casual workers, commissions, office equipments, legal and audit fees, research, development and statutory compliance.

Businesses having 20 or more employees usually spend an average salary of Rs. 4.50 lakhs or more per year for managing payroll and other statutory compliances according to the current minimum wages rates published by respective states of India. These costs can be reduced by outsourcing payroll and other compliances for an affordable price.

Eventhough your manager or controller is aware of statutory compliance under various legislation, it is very difficult to follow or aware of periodical changes in regulagions like minimum wages, shops and commercial establishment, factories, national and festival holidays, payment of wages etc made by Government in a timely manner.

It is also hard to overcome the situation when your controller leave your establishment for good with their knowledge and it is undestood that an average 40% of business establishments pay penalties for late or incorrect filing.

We can overcome these issues by outsourcing payroll process and other statutory compliance.

Direct deposit plays a key role in wage protection system. Direct deposit is a deposit of money by a payer directly into a payee’s bank account.

Wage Protection System (WPS) is a measure to safeguard the payment of wages of workers via direct deposit. In WPS, the payment of salary in private institutions will be made mandatory through bank accounts. WPS is an online monitoring system introduced by the State Labour Department, Kerala to ensure the payment of salary of workers in private sectors are not below the minimum wages prescribed. This will enhance the ability of Government to lessen labour disputes relating to wages and it will guard as a solution for employers against keeping large amount of cash at work places. Direct deposit is difficult if a company doesn't use an online payroll service. We can overcome these hassles by outsourcing payroll and other statutory compliance.

Cpi is originally published by Department of Economics & Statistics, Govt of Kerala.

Download State wide CPI Updated 05/03/2020

Some of our clients

asset homes

chaithanya granites

kalinga distributors

tony enterprises

kwat agencies

tony lites

pittapillil agencies

camerry icecreams

Premier seafoods exim Pvt Ltd

ginger hotels

paragon hotels

maverick fitness

Dr Noushad's ENT Hospital & Research Center

Moolans

Sylcon

Feel free to contact us

Vennala,

Kaniyapilly Road, NH47 Bypass, Cochin, Kerala, India.

(484) 2806212.

office@paydox.in paydoxprivate@gmail.com paydox@yahoo.com

www.doxnet.in

www.paydox.in